General Information

Name Official: Republic of djibouti

Capital: Djibouti

Total Area: 23,200 km²

highest point: 2010 m

Lowest Point: -175 m

Borders: Ethiopia, Somalia, Eritrea

Political System: Presidential

Head of State: HE Ismael Omar Guelleh

Time Zone: GMT + 3

Calling Code: The international code of Djibouti is the +253

Languages:

- Somali, afar, arabic

- Frensh, arabic are official languages

-English widely spoken in the tourism and business

Currency

The currency of Djibouti is Djibouti Franc (DJF). Its parity is pegged at U.S. dollar. The international credit cards are accepted and 1 USD=177.721 DJF.

Tickets: 1000DJF, 2000 DJF, 5000DJF, 10 000DJF.

Coins: 5 DJF, 10 DJF, 20 DJF, 50 DJF, 100DJF, 250DJF, 500DJF.

Office Hours

Saturday to Thusday: 07pm 30 to 14h00.

Financial instituions practice the week of six days.

During the summer and the month of Ramadan, the system of the day can be changed.

Weights and Measures: The units used are grams and meters.

Public Holidays

|

|

Dates |

Number of Days |

|

New Year's Day |

Junuary 1st |

1 |

|

Eid Al-Adha |

From the 1st day of the pilgrimage to Mecca |

3 |

|

New Year Muslim Hegre |

Twenty days after the feast of Eid el Adha |

1 |

|

Mouloud (Birth of the Prophet) |

Depends on the lunar calendar |

1 |

|

Labor Day |

May 1st |

1 |

|

Independance Day |

27 and 28 June |

2 |

|

Al-Isra Wal Miraj |

Depends on the Lunar calendar |

1 |

|

Eid Al-Fitr |

End of Ramadan |

2 |

I. The National Investment Promotion Agency

The National Investment Promotion Agency is in the heart of social and economic system of the country since it is established in 2001. Il encourages the promotion of investment in Djibouti through a policy of flexibility in investment operations, a modern regulatory framework and procedures. As part of the investment promotion and development of knowledge of the Djiboutain territory, NIPA is responsible for putting forward the incentive environment of the Republic of Djibouti and investment opportunities.

Mission:

Our mission is to provide a full advice and support for new or existing local and foreign promoters. The National Investment Promotion Agency is a strong partner and representative of the private sector at gouvernmental level.

in its duties the National Investment Promotion Agency:

contributes to the training of promoters through seminars and training session:

II. Regulated Activity

Djibouti business environment is liberal and any local or foreign investor can invest in the different sector of activity. However there are some regulated activities which require a specific approval issued by the ministry in charge of the targeted sector.

|

Access to regulated professions |

|||

|

Professions |

Applicable Laws and Regulations |

Date |

Ministries/ Institutions awarding Approval |

|

Lawyers |

Loi N°236/AN/87/1ère L |

25 Jan 87 |

Ministry for Justice, the Business Penitentiary and Moslem, In charge of the Human rights |

|

Notary |

Loi N°170/AN/02/4ème L |

07-Jul-02 |

|

|

Accountants |

Loi N°36/AN/83/1ère L |

25-Aug-83 |

|

|

Architects |

Loi N°53/AN/83/1ère L |

04-Jun-83 |

Ministry of Housing, Urbanism, Environment and Planing |

|

Certified Translator |

Order N°80-1184/PR L |

09-Aug-80 |

Ministry of Justice, Prison and Muslim, Affairs, in charge of Human Rights |

|

Real Estate Agents |

Loi N°146/AN/80 |

16-Sep-80 |

Ministry of Housing, Urbanism, Environment and Planing |

|

Doctors |

Loi N°53/AN/83/1ère L |

25-Jan-79 |

Ministry of Health |

|

Pharmacy |

Loi N°45/AN/91/2ème L |

|

|

|

Exploitation of Salt |

Mining Code |

|

Ministry of Energy and Natural Ressources |

|

Freight |

Loi N°83/AN/00/4ème L |

09-Jul-00 |

Ministry of Equipement and Transport |

|

Fishing |

Loi N°187/AN/02/4ème L |

02-Sep-02 |

Ministry of Marine Affairs, in charge of Hydraulic Ressources |

|

Baillif |

Loi N°36/AN/09/6ème L |

21- Feb-09 |

Ministry of Justice, Prison and Muslim, Affairs, in charge of Human Rights |

|

Insurance |

Loi N°40/AN/99/4ème L |

08-Jun-09 |

Ministry of Finance and National Economy |

|

Manutention |

Décret N°2001-0128/PR/MET |

03-Jul-2001 |

Ministry of Equipement and Transport |

|

Bank |

Loi N°92/AN/05/5ème L |

16-Jan-02 |

Central Bank of Djibouti |

|

Security and Guard Private Activity |

Loi N°202/AN/07/5ème L |

22-Dec-07 |

Ministry of Interior and Decentralization |

|

Electricity independent productor |

Loi N°88/AN/15/7ème L |

01-Jul-2015 |

Ministry of Energy and Natural Ressources |

III. Setting Up a Company: STEPS

The Djiboutian legal environment is favorable to the businesses. You can create your company in djibouti whatever your nationality or your place of residence is.

Foreign investor does not need a djiboutian partner to start a business in Djibouti apart from the activities of tranit and insurance. The activity of handling is also only reserved for the Djiboutian.

All procedures are done within three days at the NIPA' One Stop Shop with representatives of all institutions involved in the business environment.

The most current types of companies are:

The Steps to Set Up Your Company:

Required information for the article of association

Elaboration of company registration file

Registration at the register of Commerce

Fees:

Fiscal registration of article of association and commercial lease

Fees:

Proved documents:

Sosial registration:

To create a branch

Documents to present:

Provided documents:

Commercial name certificate

IV. Start Up Cost

|

|

|

DJF |

USD |

|

Registration fees (Register of Commerce) |

LLC SA EURL ASC |

132 500 |

747 |

|

Legal fees (with notary & Lawyer) |

Legal fees for following up on general official registration matters (depending on volume and subject-matter) |

100 000 |

563.38 |

|

Work permit |

COMESA member countries Nom COMESA member countries Gulf citizen Europe/Americ |

200 000 |

1126.76 |

|

Presidence Permit |

Africa Asia Europe America |

35 000 40 000 45 000 50 000 |

196 225 252 280 |

V. Investment Code

The Investment Code provides incentives for certain activities, depending on the investment (5 million DJF approximately 30,000$) and the number of local jobs generated by the project. The National Investment Promotion Agency is in charge of Investment Code management. One of the most salient features of the Investment Code is that it gurantes equality between domestic and foreign.

1) Exemptes activities for Regime A: 5 to 50 million DJF

2) Exemptes activities for RegimeB: 5 to 50 million DJF

All the activities of the Regime A more the activities are follows

Supporting Documents of application for investment code incentives

Any promoters of investment projects, seeking the benefit of tax exemptions and other structural facilities granted by the Investment Code, must provide prior to any implementation this projects the following documents:

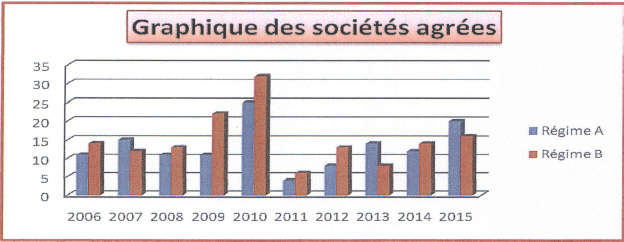

1- Growth of companies that benefited from the investment code

The chart below shows the evolution of projects that has benefited from this exemption.

after a light showing down 2011, the number of the tax-exempt companies positively evolved , and we notice the evolution of this trend running on the last three years.

One of the conditions that companies have to fulfill is the creation of a local job according to their activities and their amount of investment. A specific skill which has not been found in the country can be done by expatriated . Those companies have a period of 18 months to start their activities and hire local jobs. The regime a corresponds to 5 years exemption and is given to the small and medium projects , whereas the regime B is attributed to bigger investment for a period of 7 years.

VI- Taxation

When you have a business in an industrial , commercial or liberal activity, you are subjected to the payment of a certain number of taxes listed below. what are the taxes applied and their rates and who can be exempted ?

The Activity and importer patent

The contribution to the activity patent is due by anyone , national or foreigner , who posses commerce , an industry or a profession not included in the exceptions indicated in the General Tax Code (ART 91 GTC)

How this patent is calculated

The patent is composed by a fixed right and a proportional right which elements of calculation are defined by the General Tax Code.

Any individual or entity engaged in an import activity has also to take an importer patent.

The value added Tax and Home consumer Tax

Any individual or entity including the companies of the Free Zone and those benefiting from the Investment Code( with turnover equal than 50.000.000 DJF) as well as community services or public entity realizing a taxable activity must pay the value Added Tax (Art 173/174 GTC).

The Home consumer Tax (TIC) is paid on the products imported and consumed in Djibouti.

How the VAT is calculated?

The Value Added Tax represents 10% of services products . The Home consumer tax depends on the nature of the product.

Who is exonerated?

The companies , which , benefit from the Investment Code exemption are subjected to the Home Consumer Tax. Those operating in the real estate sector as well as hotel industry and processsing industries are exempted.

The License

All entities or individuals who have obtained prior administrative authorization to run trade of alcoholic beverages, including officers mess, clubs, community and associations which sell those beverages exclusively to their members , is hence subject to a special contribution called "license"( Art 130 GTC)

How this license is calculated?

The tariffs of licenses are calculated based on the nature of the operations performed and location where trade is ran.

Tax on Wages and salaries (ITS)

Any individual who receiving a salary against a professional activity performed under the authority and direction of another, public or private entity or person is subjected to the payment of tax on wages and salaries. This tax is subject to deduction withheld by employer (Art3) .

How this tax is determined?

The ITS is calculated on the basis of a salary scale with a progressive rate established by the GTC.

Income Tax

The income tax is established on the profits made by individuals or entities running a commercial, industrial, handicraft, or liberal professions, excepted, exonerated ones(Art19)

How this tax is determined ?

The tax equals 25% of the annual net profits

who is exonerated?

The companies which are benefiting from Investment Code ( under the Regime B) are exonerated of this tax as well as income from property and income from assets .

The minimum flat tax ( MFT)

The MFT is due by individuals and entities running a handcraft, commercial, industrial, or other liberal profession. iis a tax on the turnover realized on the national territory and not deductible from the taxable profit. The MFT is due on the hypothesis of a deficit result. The MFT equals to 1% of the turnover and the companies benefiting from investment code are subject to this tax(Art 57GTC).

The tax on wages paid to individuals or entities not residing in Djibouti by debtor established in Djibouti

It is a tax perceived by the means of a withholding at sources on earnings paid to individuals and entities not residing in Djibouti. The taxable earning are the sums paid against services rendered and those perceived on the author rights and products of industrial, commercial property or similar activities.

how this tax is calculated?

The tax equals to 10% of the gross amount of the earning paid.

The tax on services

The sector of services providers and hotel services ( not affected by the VAT) , are solely subjected to the payment of tax on services ( Art 213 GTC). The tax is to be paid spontaneously every month .

how is calculated?

The tax equals to 10% of service provided.

The tax base equals the total of sums and advantages received and if also

Applicable to the value of the goods incorporated in the delivery of the service.

VII. OPERATIONAL COST

Subscriptions to service providers (Electricity of DJIBOUTI. National Office for Water and Sanitation and DJIBOUTI TELECOM)can also be made directly at the One Stop shop of the National Investment promotion Agency.

A.ELCTRICITY

The Electricity of Djibouti(EDD) is the public institution in charge of enrgy supply in Djibouti.Detailed and full information about fees and related services of Electricity of Djibouti can be found through the Arrete n 2016-455/PR/MEERN

How to get new connection:

Requeired documents:

Connection

New subscription to an exisiting connection:

How to cancel?

Costs of Electricity

The Costs are available in l'Arrëté N°2016-455/PR/MERN

B. WATER

National Office for Water and Sanitation (ONEAD) is the public institution in charge of

Water supply in Djibouti. Detailed and full information about fees and related services

Of this institution can be found through the “ Arêté N° 2014-738/PR/MAEPE-RH ”.

1) How to get a subscription?

2) Advance on Consumption

|

Advance on Consumption |

Djiboutian Subscriber |

Foreign Subscriber |

|

Deposit |

6420DJF / 42 US $ |

48990DJF / 253 US $ |

|

Registration fees |

900 DJF / 5 US $ |

900 DJF / 5 US $ |

3) Cost of water

The Cost are available in “Arêté N° 2014-738/PR/MAEPE-RH” .

C. TELECOMMUNICATIONS

Djibouti Telecom is the telecommunication service provider in Djibouti. Detailed and full information about fees and related service of this institution can be found through the internet website www.adjib.dj.

1) How to get a subscription?

Allcasts and the offers of communications and internet are available in the site of Djibouti Telecom www.adjib.dj.

VIII. ACCOMMODATION

The Republic of Djibouti has a various range of hotels with different standard. Here are some addresses located in city centre and around 15 to 20 minutes from the Djibouti international airport.

Hotels: some addresses

|

Hotel Name |

Cost per Night in DJF |

Telephone |

|

Kempinski Palace H otel |

62000/69000 |

21 32 55 55 |

|

Sheraton hotel |

22680 /38420 |

21 32 80 00 |

|

Hotel Atlantic |

25960/30022 |

21 33 11 00 |

|

Imperial Hotel |

18000/25000 |

21 35 22 20 |

|

Hotel Bellevue |

17500/19000 |

21 35 80 88 |

|

Hotel Residence del'Europe |

17800/19810 |

21 35 50 60 |

|

Hotel La Siesta |

17060/20400 |

21 32 23 00 |

|

Hotel Alia |

16800/18800 |

21 35 82 22 |

|

Hotel PleinCiel |

16300/19300 |

21 35 38 41 |

|

Hotel Ali-Sabieh |

11300/15000 |

21 35 32 64 |

|

Hotel Menelik |

15820 /20340 |

21 35 11 77 |

|

African Village |

11300/14300 |

21 34 01 02 |

|

Hotel ACACIAS |

33554/45916 |

21 32 78 78 |

|

Appartement Hotel Moulk |

30 551 |

21 34 57 59 |

|

Auberge Le Sable Blanc |

7700 |

21 35 11 63 |

|

Hotel Djibouti |

7000/9500 |

21 35 64 15 |

|

Residence Lagon Bleu |

12995/14125 |

21 32 78 32 |

|

AubergeSharaf |

10900/12900 |

21 34 43 41 |

|

Auberge Le Heron |

12900/15700 |

21340001/ 21 32 4343 |

In terms of housing, expatriates have the possibility to rent a furnished or unfurnished houses for their families. The prices vary depending on the location, size or quality. The rental prices of a three-room apartment in the city centre and around vary between 600$ to 900$ per month. There are also spacious villas in suburbs, their prices also may vary depending on location, size and quality (around 1200 US$ to 1500 US$ per month).There are some real estate agencies offering services.

The sale and rent of warehouse, office, and shop vary also widely depending on size and location as well as quality. The following table can give you an idea of rental prices of office and shop. The sale of industrial land sell by the state is around 17 US $ per m2.

Rental

|

Type |

Detail |

Price DJF |

Unit of measure |

|

Office |

City Centre |

100 000-150 000 |

22-35 m2 |

|

Office |

Periphery |

70 000-90 000 |

35-50 m2 |

|

Shop |

City Centre |

50 000-80 000 |

15-25 m2 |

|

Shop |

Periphery |

35 000-50 000 |

15-20 m2 |

|

Warehouse |

|

1 million |

1000-1500 m2 |

LAND ACQUISITION

In Djibouti, any investor Djiboutian or foreign eligible for investment code incentives or not, can buy or hire a land from the state or the private sector. A foreign investor can buy and possess a land for ever.

The NIPA One Stop Shop, in collaboration with the Directorate of Estates and the Land Conservation, assists investors in obtaining land for an investment program. For that the following information are needed: